Excel rate of return on investment

Required Rate of Return 64 Explanation of Required Rate of Return Formula. A set of evenly spaced cash flows.

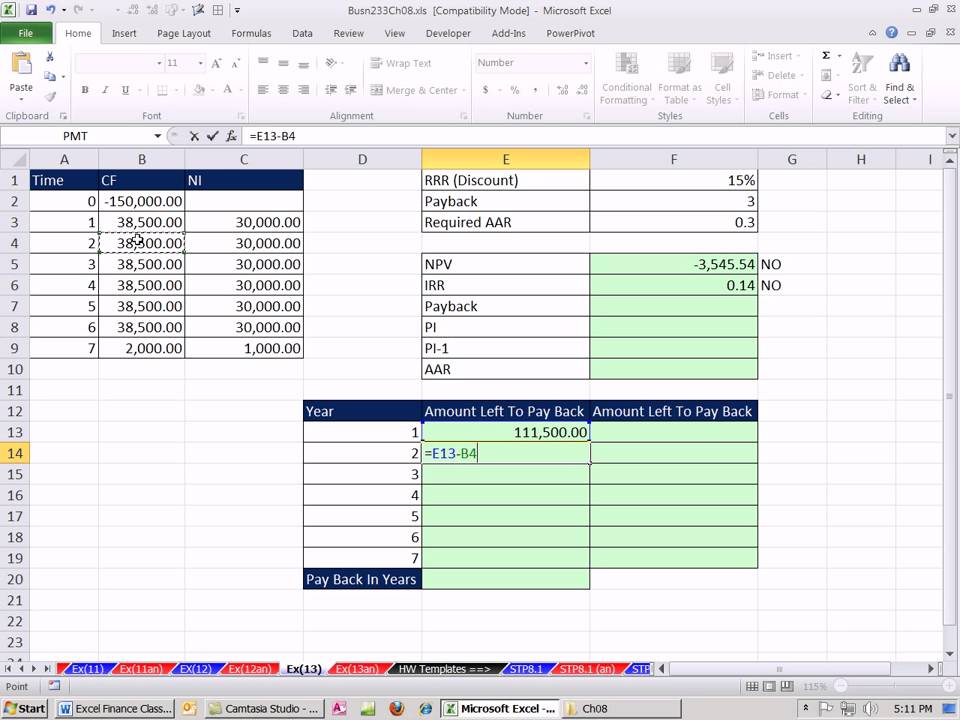

Excel Finance Class 79 Investment Criteria Npv Irr Payback Aar Profitability Index Youtube Finance Class Investing Payback

Here is the step by step approach for calculating Required Return.

. Units for rate and nper must be consistent. It takes the initial investment interest rate and the interest earned from the earned amount and returns the MIRR. The internal rate of return can be calculated using the IRR function in Excel.

Practically any investments you take it at least carries a low risk so it is. Heres how to calculate MIRR in excel MIRR In Excel MIRR or modified internal rate of return in excel is an in-build financial function to calculate the MIRR for the cash flows supplied with a period. To calculate IRR in Excel you need.

The real rate of return is now 5. For example if you bought gold in 2010 worth 200 and worth 500 in 2018 CAGR is how this investment has grown every year. Theoretically RFR is risk free return is the interest rate what an investor expects with zero Risk.

The nominal rate of return is still 10. The internal rate of return allows investments to be analyzed for profitability by calculating the expected growth rate of an investments returns and is expressed as a percentage. Average Rate of Return 3556 Explanation of Average Rate of Return Formula.

The FV function can calculate compound interest and return the future value of an investment. The most detailed return measure is the Internal Rate of Return IRR which measures all the cash flow received over the life of an investment or campaign. This is C2C7 in the IRR Excel example above.

The Kickass Entrepreneur About. This free real estate investment spreadsheet will quickly allow you to calculate an investment propertys CAP rate IRR rate return NOI and help you determine the suitability of an investment property. The figure presents an annual percentage growth rate and accounts for.

What is the real rate of return. It is the total return of the investment without considering inflation and taxes. To determine the internal rate of return of an investment follow the steps.

In reality the growth rate should vary from year to year. The image below shows the formula behind. With the help of CAGR it can be seen how much constant growth rate the investment should return on an annual basis.

The Excel function would read LN1110 for a result of 953. However because some months have 31 days while others have 30. 10 1 20.

It is calculated as follows. If you would prefer to skip directly to download the investment property calculator excel spreadsheet. For example if you make monthly payments on a four-year loan at 12 percent annual interest use 1212 annual rate12 monthly interest rate for rate and 412 48 payments total for nper.

Average Rate of Return 1600000 4500000. The internal rate of return for an investment only measures the return each period on the unrecovered investment. If you make annual payments on the same loan use 12 annual interest for rate and 4 4 payments total.

Excels IRR function calculates the internal rate of return for a series of cash flows assuming equal-size payment periods. To configure the function we need to provide a rate the number of periods the periodic payment the present value. As an example to find a continuously compounding rate of return lets say the ending value of an investment was 11 and the beginning value was 10.

The range C5 to E5 represents the investments cash flow range and cells D10 and D11 represent the rate on corporate bonds and the rate on investments. The average rate of return will give us a high-level view of the profitability of the project and can help us access if. Using the example data shown above the IRR formula would be IRRD2D14112 which yields an internal rate of return of 1222.

Formulas are the key to getting. The drawback to the IRR function is that Excel assumes each cell is separated by precisely twelve months which is not always the case. Required Rate of Return 27 20000 0064.

The syntax of the IRR function in excel. How to Calculate IRR in Excel. The XIRR Excel function is preferable over the IRR function as it has more flexibility by not being restricted to annual periods.

You can use RRI to calculate Compound Annual Growth Rate CAGR in Excel.

Excel Roi Calculator Calculator Spreadsheet Free Download Financial Calculator Excel Calculator

How Internal Rate Of Return Irr And Mirr Compare Returns To Costs Investment Analysis Investing Analysis

How To Calculate Irr In Excel Excel Calculator Page Layout

Irr Internal Rate Of Return Definition Example Financial Calculators Balance Transfer Credit Cards Cost Of Capital

Roi Calculator Formula Investing Financial Management Online Advertising

Download Npv And Xirr Calculator Excel Template Exceldatapro Excel Templates Financial Analysis Templates

How To Calculate Future Value With Inflation In Excel Exceldemy Excel Formula How To Introduce Yourself Excel

See The Effective Rate Of Return Calculator Effective Annual Interest Rate Calculator Manual And Excel Formula Return On I In 2022 Interest Rates Excel Formula Rate

Investment Property Excel Spreadsheet Rental Property Rental Property Investment Investment Property

Get Our Image Of Real Estate Investment Analysis Template Mortgage Comparison Investment Analysis Income Property

Capital Investment Models Internal Rate Of Return Investing Cost Accounting Capital Investment

How To Calculate Irr In Excel Npv Irr Calculator Excel Template Excel Templates Excel Calculator

Server Software Return On Investment Calculator Use The Server Software Return On Investment Calculator To Calculat Investing Calculator Spreadsheet Template

Calculate Financial Formula Irr And Npv In Excel By Learning Center In Urdu Hindi Youtube Sms Language Learning Centers Excel Tutorials

Roi Spreadsheet Example Spreadsheet Template Excel Spreadsheets Templates Spreadsheet

How To Calculate Irr Internal Rate Of Return In Excel 9 Easy Ways In 2022 Excel Cash Flow Calculator

How To Use Npv Vs Irr Formula In Excel Excel Formula Excel Microsoft Office Word